Helping Military Families Protect What Matters Most

Secure your future with a strategy built for those who served.

Most Veterans Face the Same Roadblocks:

Limited Financial Education

Time Constraints and Overwhelm

Risk and Uncertainty

Whether you're active duty, transitioning, or retired, I build custom strategies that protect what you’ve earned. Here's how I help:

Expert Financial Guidance (You Can Actually Understand)

You’ll never be left in the dark. I break everything down in plain language so you can make confident, informed decisions.

Tailored IUL & Retirement Strategies

Not a one-size-fits-all pitch. I craft a personalized plan aligned with your career, goals, and values—not Wall Street's agenda.

Exclusive Access to Long-Term Growth & Protection Tools

Build wealth, shield your savings from taxes and market dips, and ensure your loved ones are always protected.

What You Get With Your Veteran-Focused Strategy

Tax-Free Retirement

Keep more of what you earn—without future tax penalties

No Market Losses

Your money grows safely—even when the market crashes

Family Protection

Guaranteed death benefit ensures your loved ones are covered

Flexible Access to Cash

Use funds when you need them—no penalties, no stress

Legacy Planning

Leave behind financial security, not just a folded flag

1000s

SERVICE MEMBERS EMPOWERED

99+

HAPPY REVIEWS

$2.5M+

IN WEALTH PROTECTED FOR MILITARY FAMILIES

100%

VETERAN-FOCUSED GUIDANCE

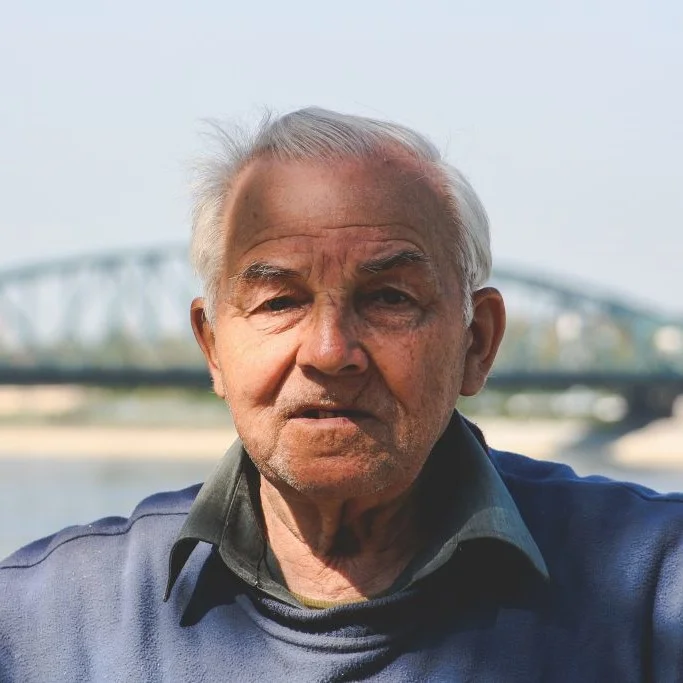

Success Stories: Hear from Our Satisfied Clients

“Del explained everything in a way that made sense. I had no idea how powerful an IUL could be until he broke it down step by step. He didn’t push anything—just listened, answered every question, and helped me build a plan that feels right for my family. I finally feel in control of my financial future. Highly recommend working with him.”

- SFC James H., U.S. Army Ret.

“I’ve worked with a few financial professionals, but none have been as down-to-earth and committed as Del. He genuinely cares. He helped me set up a plan to protect my wife and kids if something happens to me. I’m a veteran—and for once, I feel like someone actually put my family first.”

- Andre T., U.S. Marine Corps Veteran

“Del helped us see the bigger picture. My husband and I were thinking short-term, but after working with Del, we now have a legacy plan in place for our children. His calm, respectful communication style made it easy to trust the process—and he made sure we understood every part of it.”

- Jasmine R., Military Spouse

Frequently Asked Questions:

An Indexed Universal Life (IUL) policy is a powerful financial tool that combines life insurance with a tax-advantaged savings component. It allows your money to grow based on market performance, without exposing you to market losses. As a veteran, an IUL can help you build tax-free retirement income, protect your family with a death benefit, and create a legacy that lasts.

While TSPs and 401(k)s are tax-deferred and tied to the stock market, IULs offer tax-free withdrawals, no penalties, and no market risk. You’re in control, with the ability to access your money when needed without worrying about losing it in a downturn or paying heavy taxes later.

Absolutely. In fact, the earlier you start, the more you can benefit from compounding growth and lower insurance costs. I work with active duty service members, veterans, and military families to build financial strategies that adapt to your career, income, and goals.

During your free session, we’ll discuss your current financial situation, identify your goals, and walk through options like IULs, retirement planning, and legacy protection. You’ll leave with a custom strategy and a clear understanding of how to move forward—no pressure, just guidance.

It’s much more than life insurance. What I offer is a holistic financial approach built specifically for those who served. That includes protecting your income, growing wealth tax-free, planning for retirement, and ensuring your family is taken care of—now and for generations to come.